We are seeing an unprecedented incident in the world unfolding at a pace that is unlike almost anything we have seen with the Corona Virus. Mass business closures mandated by government, shelter in place orders, an overwhelmed medical/first responder system and fucking toilet paper hoarding among the list of what is going on. I’m not discounting the illness and loss of life, this is a business related article, so bear with me here.

Is your business going to survive the Corona Virus?

Sadly, many will not. But many will. I don’t know if mine will but I am doing everything I can to make sure it does. I’m going to share what I have learned and done so far in hopes that it helps you. First, ask for help from your members and clients. If you’ve done a good job creating a community, they will want you to survive.I was ashamed to ask my members to keep their dues active, but after running numbers and projections, I changed my tune.

I asked them to and most of them are doing it. They love TPS and want it to be here when this is all over. The outpouring of support we got was mind blowing. Of course some cannot because they lost their jobs, so we cancel or freeze them. We understand. Next, talk to your landlord or mortgage company. They want you to be here after too. Most of them will either:- Defer

- Delay

- Issue a mortgage forbearance

After that, look at the SBA options available to you.

From what I’ve read and researched there are two options available for small business owners.-

EIDL Loans

-

Payroll Preservation Loans

The Paycheck Protection Program.

This is, in a nutshell, the fastest and easiest way to get cash flow for your business as a result of the stimulus. It needs to be done through an SBA approved lender, and as of this writing, they don’t have guidelines according to my bank, but will in a few days. The Paycheck Protection Program, from what I have read, gives you 2.5 times your monthly payroll right away as a loan. Any funding that is used for payroll, payroll related costs, or rent/utilities within 8 weeks of the origination of the loan is forgiven. Yes. Forgiven. It’s a grant. If you have a $20,000 per month payroll, that is a check for $50,000 dropped in your account that you don’t have to pay back if you use it for rent and payroll. This is an ideal way to keep your employees paid so they can support their families. And if I were you, I’d pay my employees first. Deal with the rent later. Your team is your lifeblood in this industry and you are nothing without them. Take care of them. Once you have this done, start figuring out ways to continue to serve your members and keep your community alive. If you have employees, delegate this to the best ones. I did. At TPS, we are hosting online Group Exercise classes FREE on Facebook live, and sending out training sessions via email that have three options:- No equipment

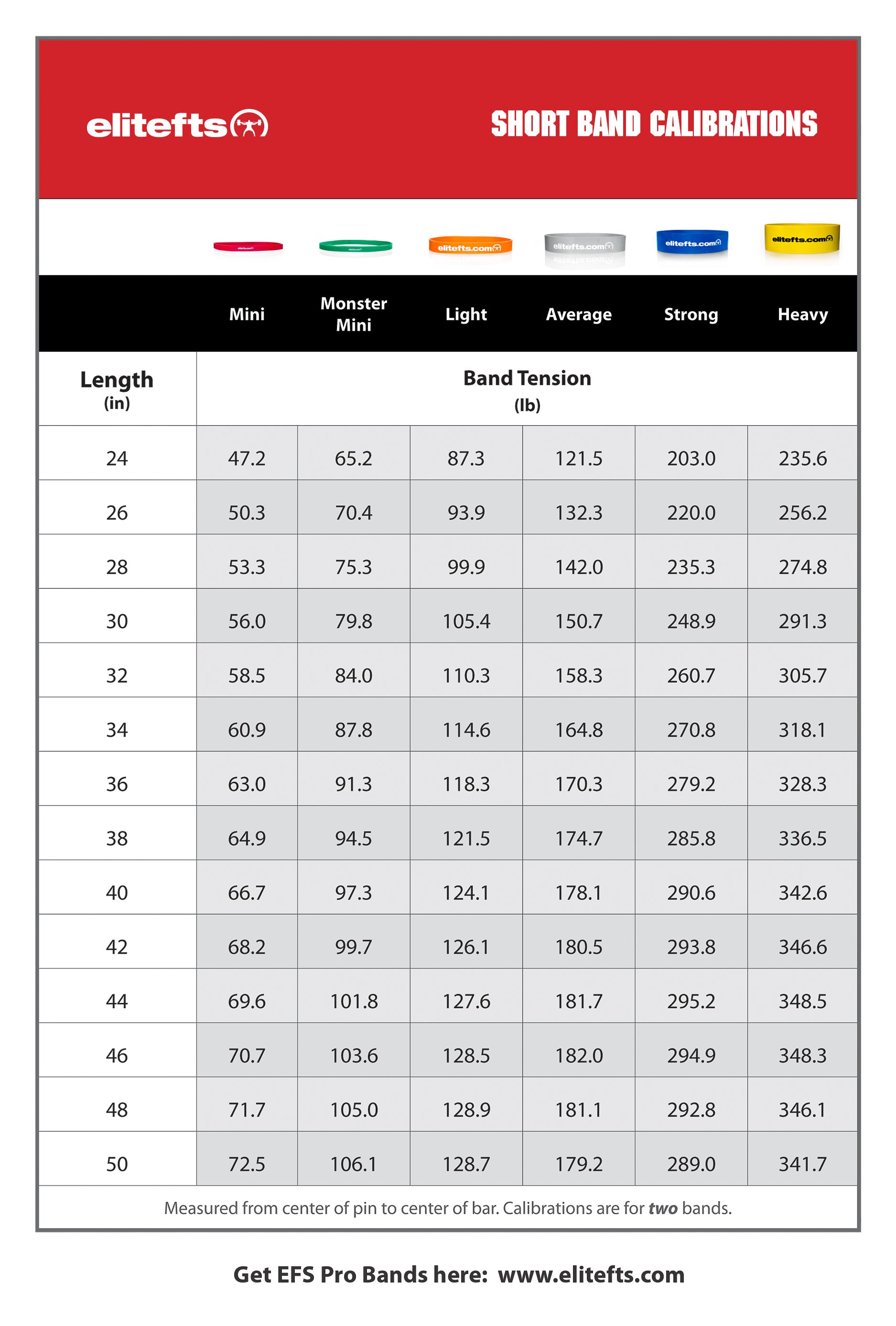

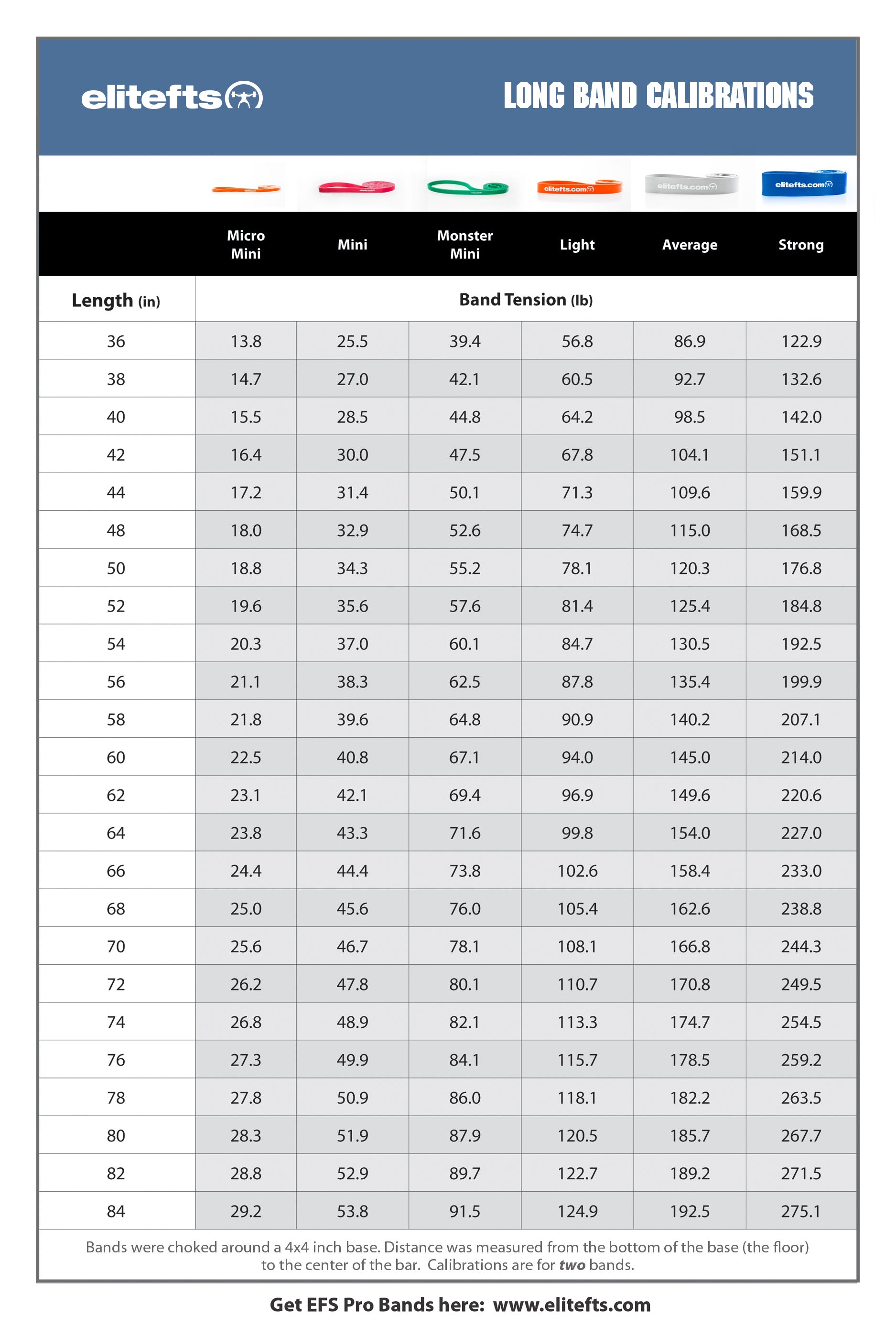

- Bands and light weights

- Access to a home gym

It’s not much, but we only had a few days to figure it out. We are also working on more content for TPSMethod.com and looking into how to do online services FREE such as nutrition lectures, at home training ideas and more. Keep your community alive. That is all I have for you today, I hope it is helpful. Leave a comment with what you are doing. I’d love more ideas. Did you miss last week’s log?

Read it here

Oh, yeah, follow us on Instagram too. @TPSMalden @tpsmethod DM ME QUESTIONS THERE TOO! You might be featured in a Coaching Log And @tpsmethod SHARE THIS! #bostonsstrongest Vincere vel mori

C.J. Murphy

March 30, 2020